By Deletra Hudson, The Financial Educator

Recently, I received a request from one of my followers asking for suggestions on how to get started with investing on a small scale. As a result of that inquiry, here are two avenues to get started with investing on a small scale, Stocks and Bonds.

Stocks

What are stocks?

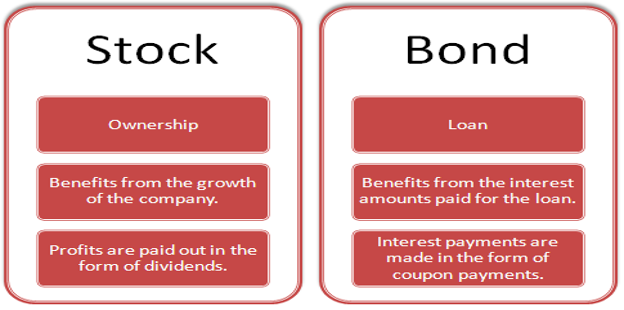

Investopedia defines stocks as a type of security that signifies ownership in a corporation and represents a claim on part of the corporation’s assets and earnings.

Before you enter the investment world, simply remember to always invest in what you like. If you invest in what you’d like, you have more of an interest in that company and how it is going to perform for you. Also, when you invest in what you like, you are earning dividends on your investment typically from buying goods and services from a company that you would patronize anyway. For example, if you like Nike tennis shoes, invest in Nike stock. If you like to shop at Walmart or drink Starbucks coffee, invest in those companies. When you make your purchases, you contribute to the sales growth or profits (if the company is profitable). As a result, as a shareholder, you maximize the possibility of you receiving a dividend payment.

What is a Shareholder?

A shareholder has a claim to a part of the corporation’s assets and earnings. The shareholder’s number of shares determine the ownership amount the shareholder has of the company. For example, if 1,000 shares of stock were issued for ownership of an entity and you bought 100 of the 1,000 shares; you own 10% of the company.

What is a dividend payment?

Merriam-Webster defines a dividend as an amount of a company’s profits that the company pays to people who own stock in the company

How to get started with stock investing?

These three steps will help guide your decision about with which companies you choose to invest.

- Research the company

- What does the company stand for with its commitments to society? You may find, through your research, that the company has a deep rooted commitment (positive or negative) to the world that you may not know.

- How is the company’s stock is performing? If your research reveals a combination of a consistent dividend payout and an increasing stock price, chances are, you have a strong company worth your investment. If your research reveals constant decreases in the stock price with reports of no profitability, the company may have a weak or weakening position that would raise concerns for investors.

If you’re interested in investing in stocks on a very small scale, there are several websites that can help you get started. Remember no one can predict stock performances. The activity of the stockholders who holds the largest percentage of the shares dictates the stock performance because they control the company’s activities.

If you want to try your hand at investing in stock, with lower risk, there are sites that allow you to buy small numbers of shares without a broker:

- oneshare.com

- giveashare.com

Bonds

What are Bonds?

Investopedia defines bonds as a debt investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or fixed interest rate.

If bonds are of your interest and you want to start on a small scale with minimal risk, try US Savings Bonds through the US Department of the Treasury. US Savings Bonds are some of the safest bond investment vehicles available because the United States Governments guarantees the repayment of the bonds.

What are Savings Bonds?

Savings bonds are in investment tool issued and backed by the US Treasury to meet the borrowing needs of the US Government. Over the years, families have acquiring savings bond to implement secured savings plans.

There are two types of savings bonds: EE-Bonds and I-Bonds.

Savings Bonds come in eight values: $25, $50, $75, $100, $200, $500, $1,000, and $5,000. The investments are protected because they are secured by the U.S. Government. The principal and earned interest are registered with the Treasury Department.

Savings bonds use to be issued in paper form. However, in 2012, the US Government stopped issuing paper bond certificates. Now, all savings bond purchases are done online through the TreasuryDirect.gov website. If you have old bond certificates, they may have value as a collectible since the government stopped issuing them in paper form.

I suggest you research your savings bonds options at the website designated by the US Department of the Treasury to manage savings bonds, Treasurydirect.gov.

Thanks the internet, you can find all of this information and more about Stocks and Bonds online.

If you need additional support starting your investment plan, contact me for a complimentary financial empowerment session at www.deletrahudson.com